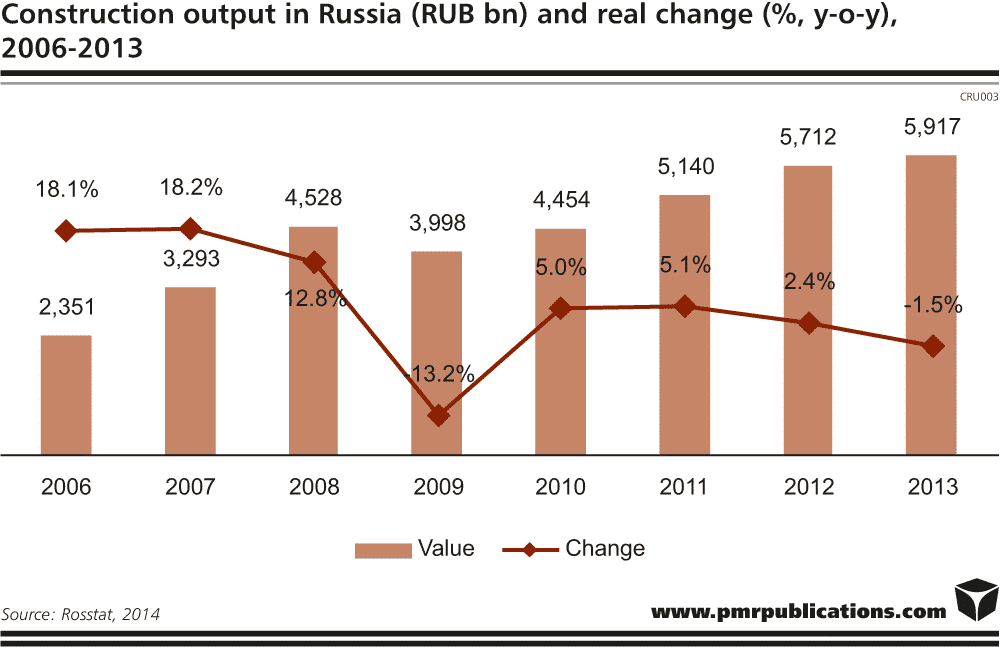

The Russian construction industry has recorded a strong slowdown in the last couple of years. According to preliminary data, Russian construction output contracted by 1.5% year on year in 2013, after a 2.4% expansion achieved a year before. It should be mentioned that during 2010-2011 the Russian construction sector posted at least 5% growth every year.

In 2013 the industry’s growth performance deteriorated significantly. According to PMR, the key factors contributing to the decline in construction activity were:

– poor economic growth performance, with GDP growth rate easing to 1.3% in 2013 from 3.4% a year earlier

– lack of growth in fixed capital investments, which recorded a marginal 0.3% decline year on year

– high base set after the strong recovery in 2010 and 2011.

According to PMR, in 2013 the construction industry was dragged down solely by the civil engineering construction sector. Many new developments have been postponed, which has ultimately delayed the expansion of Russia’s still struggling construction industry. A large share of civil engineering construction output is generated by state-funded transport infrastructure construction projects, as well as by incentives rolled out by companies in the oil and gas as well as in mining and metallurgical sectors. In 2013 about RUB 596bn (€14bn) was disbursed on the implementation of the 2010-2020 Transport System Development Programme, 0.1% less than what was allocated in 2012. However, the construction and assembly work price index amounted to 5.6% last year. Furthermore, the construction output in the Urals Federal District plummeted 13%, which is most likely due to a reduction in investments in oil and gas as well as metallurgy infrastructure-related projects.

The government-targeted programmes aimed at modernising the country’s transport, energy and social infrastructure have played an important part in the construction industry’s evolution in recent years. In addition, multi-billion projects implemented as part of the preparations for the 2014 Sochi Winter Olympics provided an additional boost to the market. In addition, a steady increase in real disposable personal incomes has supported a solid uptrend in the residential construction segment and in retail sales, which ultimately fuelled construction activity in the retail and service sector.

In 2013, 35 of Russia’s 83 administrative regions recorded a decline in construction activity, whereas a year earlier the number of underperformers totalled only 25. The three most significant increases were recorded by Astrakhan Province (+210%), the Republic of Ingushetia (124%) and the Nenets Autonomous District (+62%), whereas the Republic of Chechnya (-55%), Chukotka Autonomous District (-50%) and Tver Province (-32%) were the least productive underperformers.

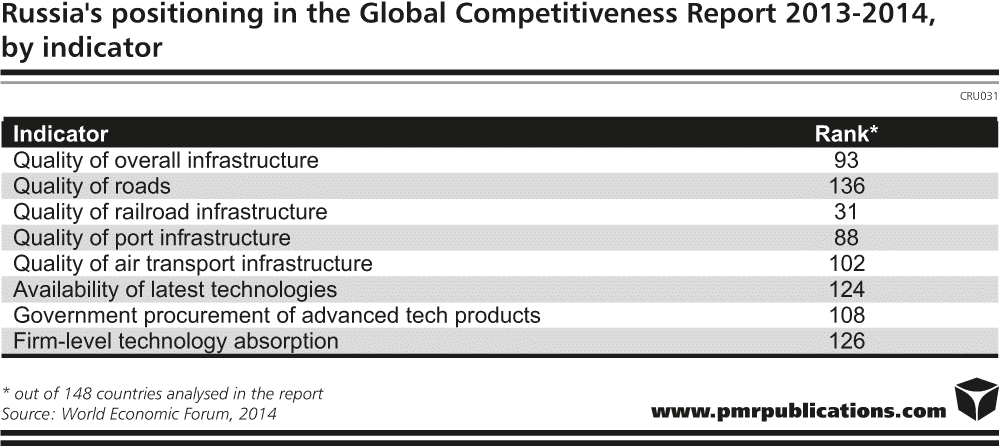

The slowdown in economic growth has accelerated in Russia since 2012, even though oil prices have been close to record highs and uncertainty over the prospect of the global economy, particularly over the European economy, has eased. Among the key factors inhibiting a more dynamic economic progress are poor transport infrastructure and a deficient power sector. In 2013 the World Economic Forum’s 2013-2014 Global Competitiveness Report ranked Russia 93rd in terms of the quality of overall infrastructure.

A programme published by the Ministry of Economy in Q3 2013 forecasting the social and economic development of the Russian Federation during 2014-2016 envisages its spending 2.5% of GDP on transport infrastructure in 2013. This figure is to remain unchanged in 2014 and 2015, and to be reduced to 2.4% in 2016. It seems to be a challenging target to achieve, taking into consideration recent performances. According to the OECD, investment in transport infrastructure projects in Russia accounted for somewhere between 1.1% and 1.5% of GDP every year during 2002-2011, except for in 2008, when this share stood at 1.7%. In addition, the projected spending on transport infrastructure for the period 2014-2016 was based on GDP growth rates of over 3%. Current projections envisage economic growth in Russia at below 3% during the next three years.

Revision of many state-funded infrastructure development programmes in the last couple of years have delayed implementation of an important number of transport and energy infrastructure projects planned for 2013. In addition, economic slowdown that has accelerated since 2012 has pressed many private investors to postpone or reduce projects planned for 2013. According to PMR, the civil engineering construction output is projected to post a marginal decline (-0.2%) in 2014, after a 4.1% contraction last year.

In 2013, the most notable performance was achieved in the residential construction sector. According to preliminary data, the number of new homes activated in 2013 increased by 10.3% year on year to 912,100, the largest amount in more than twenty years. In terms of floor space put into use in 2013, there was an increase of 5.6% to 69.4 million m², again the highest figure since 1989. It is worth noting that the highest yearly housing completion figure ever recorded in Russia was in 1987 (72.8 million m²). Still, Russia’s population has fallen since then by nearly 2 million people.

Source: pmr