This year sees the start of Slovenia’s new Cohesion Fund period 2014-2020 when the country will be able to access €3.25bn. However, this impressive figure is much less than the €4.2bn Slovenia received for investment in the period 2007-2013. Railway and industry construction may come to be one of driving forces for civil engineering output turnaround in the 2014-2019 period.

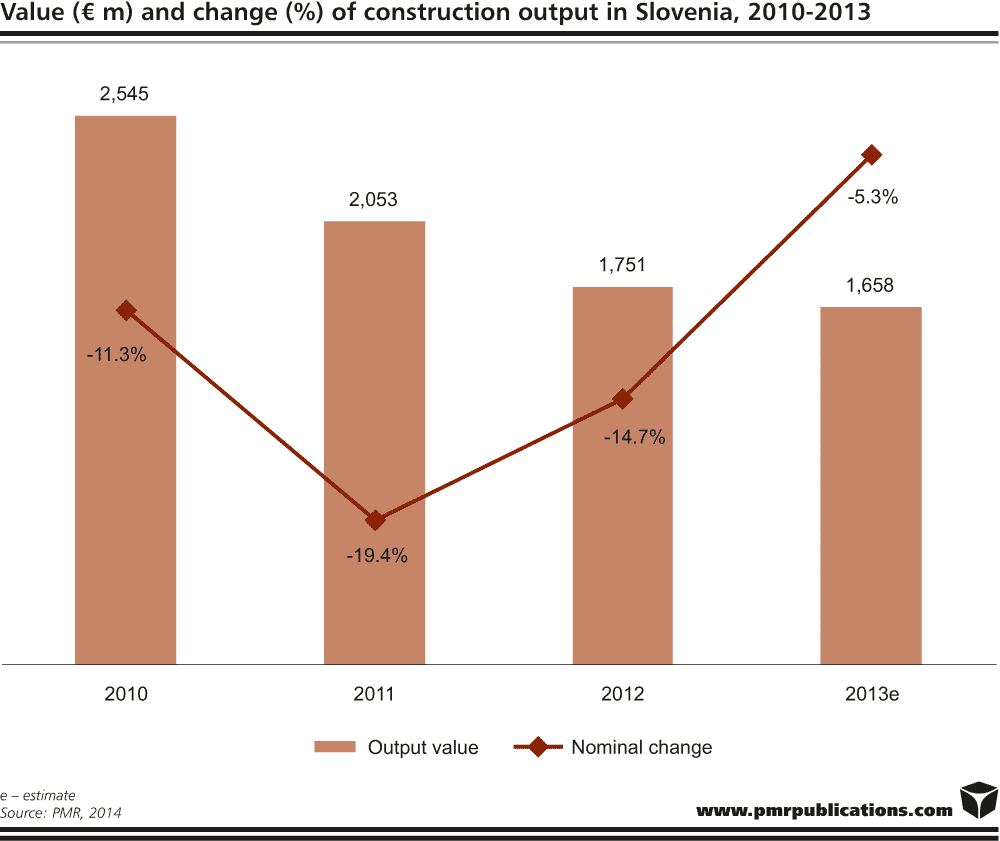

According to a new report entitled “Construction sector in Slovenia 2014 – Development forecasts for 2014-2019” published by the analysis and research company PMR, the value of construction output is estimated to have dropped by 5% in 2013 continuing into 2014 with a fall of 2-3%. However, 2015 will be the year of a construction market turnaround as macroeconomic forecasts show encouraging signs of improvement.

PMR’s timely report also highlights major factors that are to have a favourable bearing on market forecasts, these include: the availability of EU funds for new investment, the recapitalisation of domestic banks, decreasing prices of residential and non-residential buildings, improving economic conditions, and the beginning of a new era supporting construction companies.

It also considers problems with the actual implementation of planned infrastructure investment, bureaucratic barriers to project commencement, the lack of improved financial liquidity for Slovenian construction companies, and said companies continued price dumping as potential causes of adverse effects on the forecasts.

According to the study, development forecasts for Slovenian civil engineering are improving. The picture in this case is clearer and with impressive projects pending in the heavy industry construction segment. Here, PMR analysts see 2014 continuing the output turnaround from 2013, when there was an increase of nearly 5%. Green figures are also expected in 2014, meaning a healthy recovery for civil engineering.

However, in the roads segment there was no large project under construction in 2013 and nor is there one on the horizon in 2014-2019, therefore this sector will not stimulate growth in the engineering market. In 2014 the most significant task for the road construction segment will be the renovation and maintenance of bridges carrying a regional road.

On the other hand, in railway construction, 2013 showed some positive signs. Railway transport has the most potential for development in future years with possible investment exceeding €1bn by 2016. Railway construction may come to be one of driving forces for civil engineering output turnaround in the 2014-2019 period.

However, in the coming years, the most positive trend will be seen in heavy industry construction. The segment’s upward momentum has contributed to the first increase in years in civil engineering output in 2013. This will be one of key drivers for market turnaround in 2014-2019.

In contrast, non-residential construction output is expected to remain under pressure in 2014 with a steep decline. In 2015 the sector will begin a modest turnaround with a single-digit increase. Currently, the hotel construction market in Slovenia is almost in total decline with no large projects in the pipeline. Office building construction is also bemoaning its lack of incoming foreign investors does. In addition, the wholesale and retail trade construction segment is not expected to improve significantly in 2014 as the market is quite saturated. On the other hand, industrial building and warehouse construction will be the first to react to positive market movements. Attention should be also paid to the public entertainment, education, hospital, and institutional care segments. Poor public hospitals and the reconstruction of institutional care and educational centres are positive developments for non-residential output in the future. This segment will see heavy state investment in 2014 and 2015.

In residential construction, after an approximately 6% deterioration in 2013, output is still likely to be suffering in 2014. In 2015 business here will begin a modest turnaround. The most influential factor for Slovenian residential construction output will be the recapitalisation of domestic banks which will need to begin lending to investors on the Slovenian market. The two largest banks (NLB and NKBM) were recapitalised in December 2013 while several small banks will undergo the process in July 2014.

Source: pmr

Tags News