The Russian construction sector finally posted some healthy growth figures in the second half of the year. In July, a 17.6% increase was posted, reminiscent of the pre-crisis growths, and this was followed by a 12.4% increase in the value of construction works in August.

In the first half of 2011 the overall picture of the construction industry in Russia was mixed. Whilst construction companies’ financial results deteriorated, in surveys conducted by the Federal Statistics Service the companies’ managers voiced their expectations of increased profits in the future. The managers also expected the number of workers in the industry to grow whereas in the first months of the current year employment levels in construction actually fell. Although the value of construction contracts signed was higher than in 2010, this did not translate into growth in the value of construction works carried out.

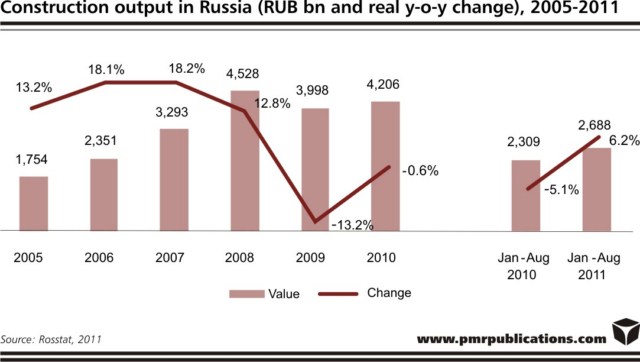

Only in July did the sector finally see an upswing. According to Rosstat, the value of construction works in July increased by as much as 17.6%, with the completion of residential floor space up by 19%. Thanks to the healthy July performance, which resembles the precrisis growth figures, overall January-July growth was brought to almost 5%, as compared to the meagre near-zero growth in the first six months of the year. This was followed by a 12.4% increase in the value of construction works in August. Overall, the value of construction output was 6.2% higher in the first eight months of the year than in the equivalent period of the previous year.

The performance of different segments of the construction industry varied recently. Whereas the residential sector remains subdued, in civil engineering the projects related to the 2012 APEC Summit in Vladivostok and the 2014 Winter Olympics in Sochi have continued to be the major drivers and many of these projects are nearing completion. In 2010 the need to focus on these priority projects meant that financing for smaller, unrelated projects, was affected. In 2011 the overall volume of spending on infrastructure development is increasing and this should result in improved support for such projects. The sector received a welcome boost late last year with the decision to award the 2018 FIFA World Cup to Russia. Stadiums and airports in all the host cities will need to be either built or modernised, and adequate road and rail connections will need to be guaranteed.

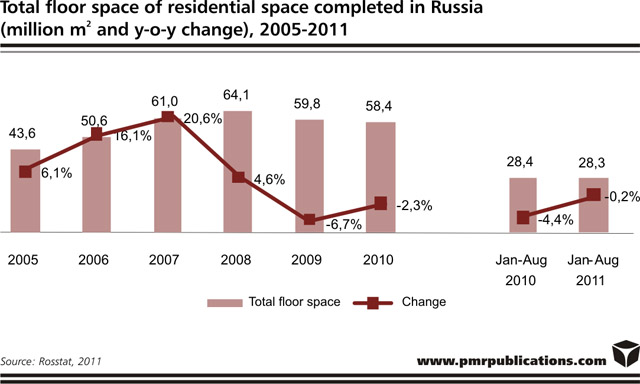

Residential construction is unable to regain the momentum that it had during the pre-crisis boom. So far in 2011, housing construction levels have been on par with 2010 levels. In order to speed up construction, not only is increased investment necessary, but perhaps first of all the continuous simplification and rationalisation of the legal environment for property development. Although necessary changes are being put in place, the process is still too slow and the number of procedures connected with housing development still far from being investor-friendly.

The outlook for residential construction thus largely depends on the government’s determination to make investors’ lives easier and to implement the bold plans set forth in the 2011-2015 Housing programme. The programme envisages that annual housing construction levels will grow by 50% by 2015, to 90 million m2. Over its five-year period the programme is expected to create 370 million m2 of housing.

On the positive side, the mortgage market is strongly increasing again, which should prompt property developers to resume projects put on hold and start new ones. This is becoming easier as banks have recently become more willing to finance residential developments.

This press release is based on information contained in the latest PMR report entitled “Construction sector in Russia H2 2011 – Development forecasts for 2011-2014”.

Latest Events News

- NordBau 2024: Construction machinery, construction equipment, commercial vehicles in construction and a Northern European congress on housing construction and heating transition

- INTERMAT 2024: the low carbon theme also at the heart of the show to improve its environmental performance

- Liebherr’s R 972 crawler excavator presented at the Intermat show

- Volvo moves to zero with decarbonization showcase at Intermat 2024

- Komatsu at Intermat 2024